Table of Contents

- Bitcoin Mining Explained

- What is PoW ?

- Infrastructure

- Types of Bitcoin Mining

- Pros & Cons of Bitcoin Mining

- Difficulty

- Bitcoin Block Rewards

- Profitability

Bitcoin Mining Explained

What is Bitcoin Mining – is a complex technological process verifying transactions before adding them to the blockchain network. People involved in the mining process are called Bitcoin miners. Since cryptocurrencies like Bitcoin are decentralized and not governed by any financial institutions or banks, Bitcoin mining is crucial for secured transactions.

Bitcoin miners use specialized hardware like ASIC miners that are algorithm-specific to solve cryptographic puzzles faster and mine new Bitcoins quicker. For instance, Bitcoin mining hardware follows the SHA-256 algorithm. Thus, with Bitcoin mining hardware, one can mine all cryptocurrencies that follow the SHA-256 algorithm.

Besides hardware, miners will need Bitcoin mining software and a wallet to mine and store Bitcoins. Bitcoin miners get paid in Bitcoins for using their computational power to validate transactions. The more advanced your device is with a higher hash rate, the better the chances of solving puzzles and mining new Bitcoins.

Bitcoin transactions are crucial for the following reasons.

- To circulate new Bitcoins

- To validate ongoing transactions

- To prevent double spend and counterfeit

- To maintain a decentralized ledger

What is PoW ?

Proof of Work (PoW) is a decentralized consensus mechanism that needs network participants to solve encrypted hexadecimal numbers. Thus, the PoW mechanism enables secure transactions without a third party verifying them.

Since PoW demands a lot of energy, the winner is rewarded with freshly mined Bitcoins. Many cryptocurrencies follow PoW-based algorithms to validate transactions due to improved security. For example, Zcash follows another PoW-based algorithm, Equihash.

Moreover, in the PoW-based algorithm, the more miners, the more the mining difficulty. Thus, when more miners join the network, there is less possibility of finding new blocks and, hence, less profits. However, mining difficulty is crucial to keep the network decentralized and secure.

Infrastructure

Bitcoin mining is a highly energy-intensive process, and it is almost impossible to mine Bitcoins efficiently with regular computers. It demands a specialized mining rig with a suitable power setup to mine Bitcoins. Let’s see the infrastructure needs for your Bitcoin mining rig in detail.

1. Mining Hardware

You will need specialized equipment like mining hardware with a higher hash rate to mine cryptocurrencies. ASICs are advanced mining hardware that are algorithm-specific and enable miners to mine cryptocurrencies efficiently.

Since Bitcoin follows the SHA-256 algorithm, you will need an ASIC miner programmed explicitly for that algorithm. Such ASIC miners come with higher hash rates, allowing miners to mine Bitcoins despite the mining difficulty. Here are some top Bitcoin miners that you can leverage for Bitcoin mining.

Additionally, since these ASIC miners demand high power, the regular power setup won’t work. Users should get an appropriate power infrastructure done by a certified electrician to run these ASICs.

2. Mining Software

Bitcoin mining software is like a computer application that is optimized for enhancing the Bitcoin mining process. For instance, the mining software directs the hardware to perform specific tasks. Thus, choosing the ideal mining software will enable miners to mine Bitcoins efficiently while enhancing their profits. Here are some top Bitcoin mining software that users can choose from.

3. Bitcoin Wallet

Next, you will need a Bitcoin wallet to receive your rewards, that is, newly minted Bitcoins. Moreover, miners can send, receive, store, transfer and also check their Bitcoin balances using their Bitcoin wallets. Here are some top Bitcoin wallets that miners can check.

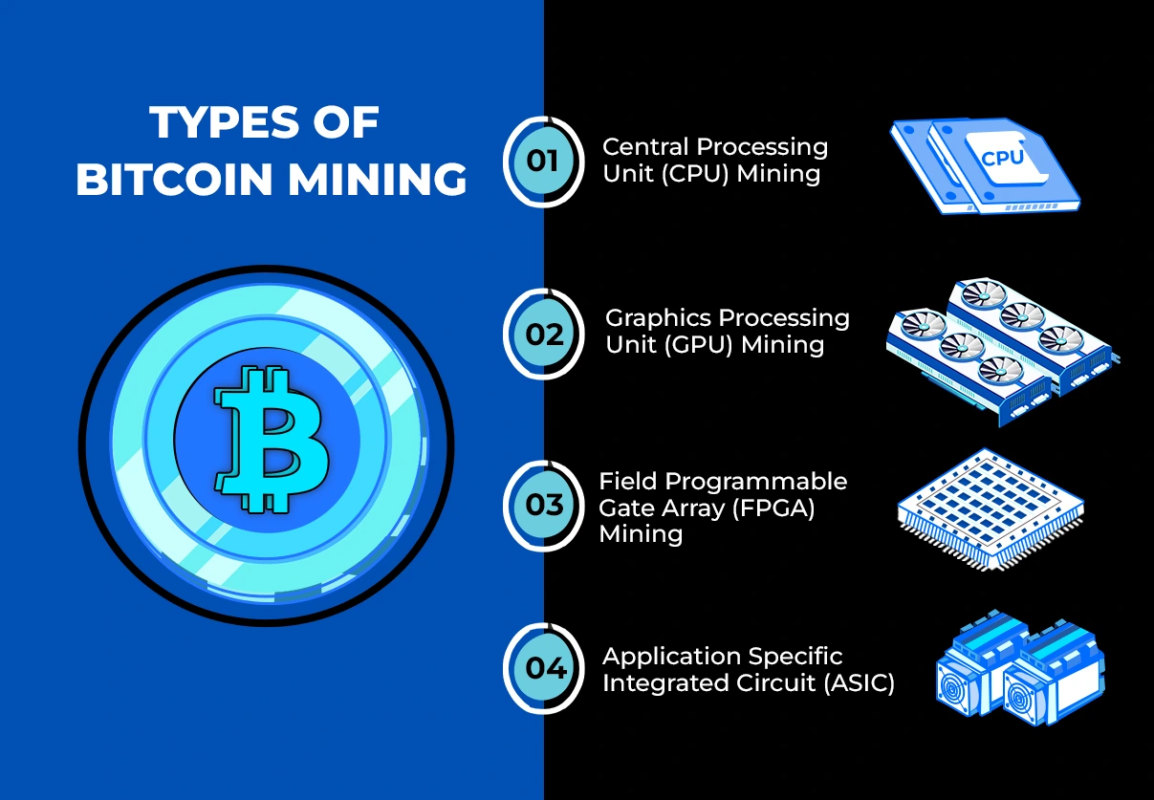

Types of Bitcoin Mining

Miners can mine Bitcoins using various devices. Let’s see one by one.

1. Central Processing Unit (CPU) Mining

Miners used their regular CPUs to mine Bitcoins when it was launched way back in 2009. Since few miners participated in Bitcoin mining, it was easy to mine it via CPUs. However, the competition is fierce now, and it is nearly impossible to mine Bitcoins efficiently with CPUs.

2. Graphics Processing Unit (GPU) Mining

Once Bitcoin gained popularity, GPUs (Graphics Processing Units) were introduced in 2010. GPUs had a better hash rate compared to CPUs. However, even GPUs were short-lived which were way more expensive than CPUs. There comes the launch of FPGAs.

3. Field Programmable Gate Array (FPGA) Mining

FPGAs, which came into existence in 2011, can be programmed and reprogrammed with different mining algorithms. Thus, FPGAs attracted a considerable crowd; however, it was not long-lasting. Though FPGAs are flexible and can be customized according to mining preferences, they come at a cost.

FPGA devices are often more challenging to build as they must be programmed to run on a customized code. That paved the way for ASICs.

4. Application Specific Integrated Circuit (ASIC)

ASICs are highly advanced mining hardware that are programmed for specific mining algorithms. For instance, Bitcoin miners are programmed for the SHA-256 algorithm, whereas Zcash follows the Equihash algorithm. Miners can pick the hardware according to the cryptocurrency they want to mine.

Moreover, these ASICs have higher hash rates that let you mine cryptocurrencies efficiently against the mining difficulty.

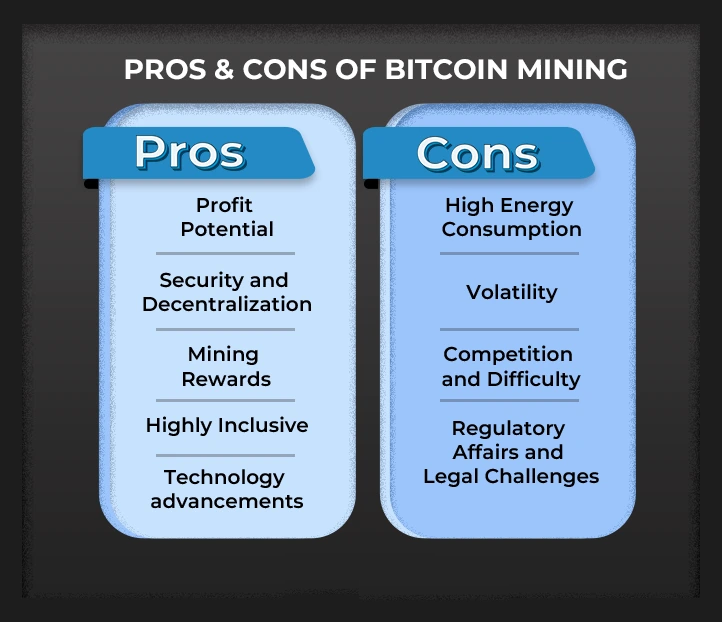

Pros & Cons of Bitcoin Mining

PROs

- Profit potential Since Bitcoin is highly popular and has some solid past performance, Bitcoin mining can result in significant returns when done right.

- Security and Decentralization Bitcoin mining helps maintain a decentralized network as miners verify and validate transactions before adding them to the blockchain network. That prevents any double spending or fraudulent activities, enhancing security.

- Mining Rewards Miners will receive newly mined Bitcoins as incentives for solving puzzles. It is a potential earning opportunity for all Bitcoin miners.

- Highly Inclusive Almost anyone can participate in Bitcoin mining provided they have the appropriate mining rig, wired internet connection and power set up. It is a fantastic opportunity for individuals and companies to generate revenue.

- Technology advancements Bitcoin mining keeps evolving like every other industry, increasing the demand for more advanced Bitcoin mining hardware. Companies will invest in research and development of advanced ASICs, benefiting not just miners but also the entire industry.

CONs

- High Energy Consumption Bitcoin mining is highly energy-intensive and is not environmentally friendly. However, with the advent of numerous mining equipment supporting renewable energy resources, the scenario will change.

- Volatility All cryptocurrencies, including Bitcoin, are highly volatile. Thus, miners can’t expect a stable income as these prices keep changing.

- Competition and Difficulty Since Bitcoin is the most preferred cryptocurrency, the competition will be fierce as more miners will join the network. That may increase the mining difficulty while decreasing the profits.

- Regulatory Affairs and Legal Challenges The regulatory and legal rules for Bitcoin mining vary from country to country, which may impact the mining profitability.

Difficulty

The mining difficulty is a parameter to determine how difficult it is to find a new block on the Bitcoin blockchain. It helps to keep the block generation constant despite the changes in the network’s computing power. Thus, mining difficulty is crucial to keep the network decentralized.

The Bitcoin mining algorithm, SHA-256, regulates the mining difficulty for the Bitcoin mining network. Mining difficulty changes for every 2,016 blocks, which takes around two weeks. Besides, the difficulty level also depends on the number of network participants. For instance, the more miners participate in Bitcoin mining, the more difficulty and the less the mining profitability.

However, besides decentralization, mining difficulty protects the network from unethical attacks as it would be hard for hackers to attack the network. Hence, mining difficulty is vital in Bitcoin or any crypto mining.

Bitcoin Block Rewards

Bitcoin transactions are recorded in a decentralized blockchain ledger, which cannot be altered once created. Hence, miners should verify transactions before adding them to the ledger. Thus, the transactions are secure while new Bitcoins are created consistently.

Miners use their network of high-end devices with excellent computing power to solve these puzzles. Thus, they are paid with rewards. For instance, Bitcoin block rewards are incentives paid to miners who solve complex puzzles first and create a new block of verified transactions.

The block reward, which is the number of Bitcoins, reduces to half after the creation of every 210,000 blocks. Bitcoin halving occurs every four years. The reward is expected to reach zero approximately in the year 2140.

Profitability

Investing in the right mining hardware and building a robust mining rig with appropriate hardware, software, Bitcoin wallet, and suitable power infrastructure takes a long way in your Bitcoin mining journey.

However, besides your specialized mining setup, many other factors play a role in determining your profitability. For instance, Bitcoin price plays a predominant role in deciding your profits. The higher the Bitcoin price, the higher your profits.

So, miners should always check the price history and past performance of any cryptocurrency they intend to mine. Here is the Bitcoin price history for the last year for your quick glimpse.

The graph shows the Bitcoin price is highly favorable, a good indicator of mining profitability. However, it keeps fluctuating. Thus, miners should watch the Bitcoin price closely.

As we know, mining is highly energy intensive and consumes a large amount of energy. Thus, other than your antminers costs, electricity costs in your locality also matter the most.

However, the profitability is beyond Bitcoin price and electricity costs at times. A sudden market trend in the crypto industry, a change in regulatory affairs regarding Bitcoin mining, a launch of a new advanced Bitcoin miner, etc, will also impact Bitcoin mining profitability.

Simply put, miners should conduct thorough research, closely monitor the market, and make well-informed decisions to mitigate unwanted risks and enhance their mining profits.

CONCLUSION

Cryptocurrencies are strongly emerging as a viable alternative to fiat currencies more than ever now. No wonder Bitcoin has always been the most preferred cryptocurrency, but now, with a positive price history, Bitcoin has attracted many investors worldwide. In fact, more than an investment, Bitcoin mining is also becoming a potential field for earning in cryptocurrencies.

The blog covers Bitcoin mining in simple terms, detailing all the relevant topics, enabling novice miners to understand the nuances of Bitcoin mining better. You can use this blog as a guide for your quick reference.

Of course, the profitability is not straightforward as many elements outside our control play as deciding factors. However, investing in the right mining setup is the first step towards a successful mining journey.

So, buying the right Bitcoin miner from a reputed mining hardware distributor will help you enhance your mining journey.